Bridging Security Gaps and Netting Ransomware Threats:

Bridgenet’s SentineOne Solution At Work in Finance

In our current digital age, online banking is the most prevalent form of day-to-day financial transactions facilitated by technology. Just as digital security and infrastructure for the banking sector have grown more sophisticated over time, so have malicious cyberattacks and methods of bypassing said security.

Some common types of malware (short for ‘malicious software’) include ransomware, spyware, viruses, and worms. Malware breaches a network through a vulnerability — for example, when a user clicks on an unsafe link or email attachment which then instals compromised software onto the user’s computer.

Ransomware, in particular, involves a hacker using the downloaded malware to encrypt and lock your entire data system for the purpose of offering you the decryption key in exchange for payment (commonly in an untraceable digital cryptocurrency).

This is especially dangerous for banks: in the event that their existing endpoint recovery solutions are ineffective, with no alternative recovery method, the encrypted data renders the recovery process near impossible. Ransomware encryption extends to restricted access to critical files, systems, applications, and client data, which are often leaked to interested — and malicious — parties should the ransom payment fall through.

Securing comprehensive networks end to end

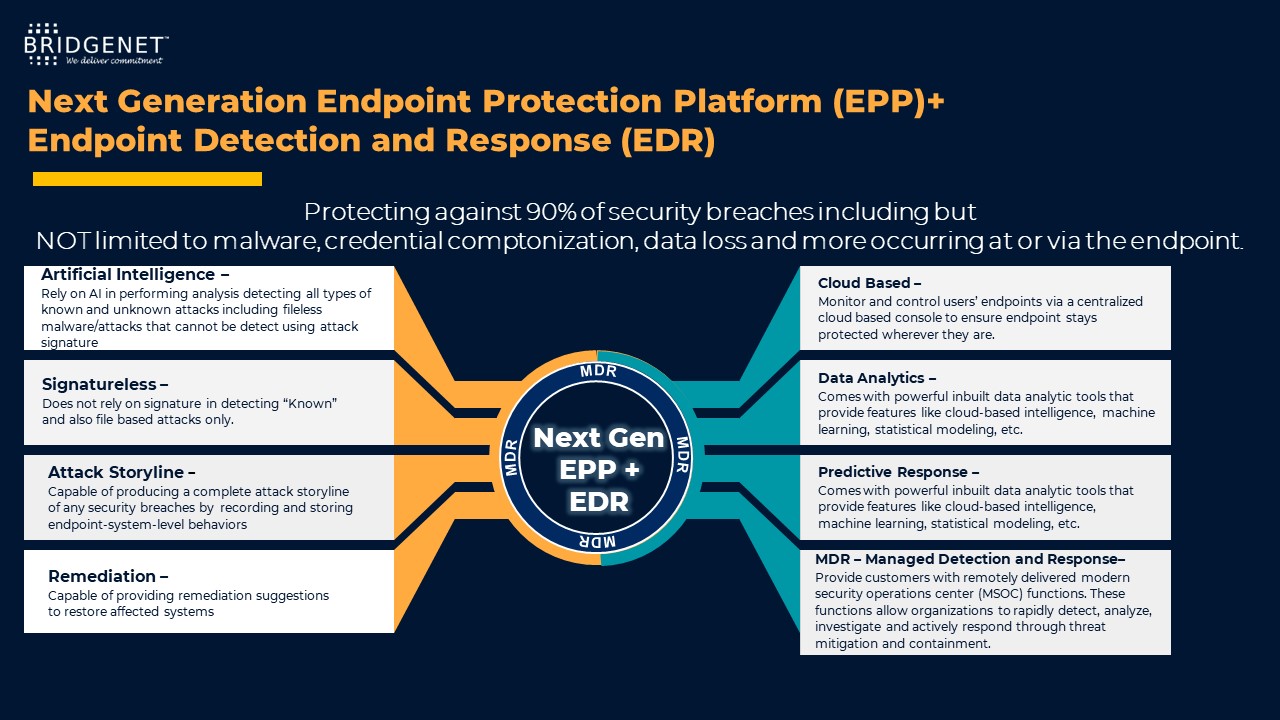

This is where Bridgenet’s innovative end-to-end network solution soars to the rescue. The implementation of a next-generation Endpoint Protection Platform (EPP) with Endpoint Detection and Response (EDR) capabilities, also known as SentineOne (S1). This S1 solution utilises a combination of static and behavioural artificial intelligence as well as global intelligence, which enables organisations to detect advanced malware and block security breach attempts on a single, unified platform.

On top of its defensive and preventive measures, this S1 system also records the entire timeline of the cyberattack for security forensics purposes. This means that users are able to ‘replay’ the entire cyberattack in chronological order to identify what was targeted and why. Additionally, this S1 solution grants users the ability to roll back the network endpoints to a pre-infected state, allowing for easier recovery of files that have been maliciously encrypted by ransomware.

Fortified system defences, coupled with this detailed record-keeping (almost like a security camera!) is especially crucial for a sector as essential and sensitive as financial services.

One system, multiple quantifiable results

Now that you’ve read about our solutions and how they work in practice, here are the tried-and-tested results and successes!

Implementing the S1 system affords users multiple benefits, such as instantaneous action response times thanks to the software’s autonomous decision-making capabilities. Facilitated by S1’s unification of prevention, detection, and response processes, this provides sturdier protection against high velocity and stealth cyberattacks.

At the same time, Bridgenet’s S1 platform prioritises the need for transparency, which is a core component of the financial sector’s handling of personal information. The operational system is managed and contextualised to meet even complex user needs.

Moreover, thanks to the quick reversal of unauthorised changes with a one-click remediation and rollback feature, the entire file retrieval process will be simplified and streamlined to ensure smooth data recovery and to provide a security safety net. To make it even easier, the S1 includes a remote device isolation and triage system that guarantees simpler restoration and repair of corrupted files, with minimal operational cost.

Banks and financial institutions are bastions of society’s security and safety. In light of how vital information and data are to these institutions, Bridgenet is all the more committed to equipping their security systems with cutting-edge protective and preventive software to eliminate risk of harm from digital malpractice. After all, cyber-security risk management enhances business resilience and public trust just as much as the safeguarding of valuables in a bank vault.